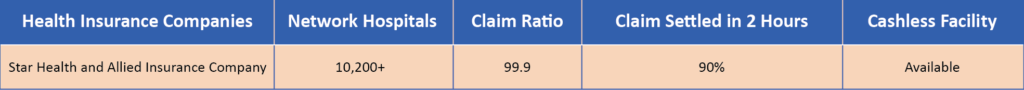

There are 30 health insurance companies in India, among which Star Health and Allied Insurance Co. Ltd is our pick. The reason is that it offers comprehensive plan coverage, has the highest claim settlement ratio and tie-up with a lot of hospitals all over the country apart from the other benefits offered.

Star Health and Allied Insurance Ltd is India’s first Standalone Health Insurance provider established in 2006. It is well known for its disease-specific health insurance plans that cater to the needs of every customer. The company has a widespread network of 10,200+ hospitals. The insurance provider spreads its branches with more than 640 branch offices across India. The insurer provides top-up insurance plans that you can tailor as per the insured’s requirement. The star health plans also come with a lifetime renewability option.

The Star Health and Allied Insurance offers benefits that include:f6d5bb

- No copayment

- The insurance doesn’t require a copayment. However, it has an exception for customers between the age of 61 to 65 years, where 20% of the claim has to be settled by them

- Life–long renewability

- Pre-existing diseases

- Pre-existing ailments are covered after a waiting time of 4 years.

- Room rent:

- The star insurance plans come with room rent expense at 2 percent of the sum assured subject to a maximum of 4000 per day

- Faster claim settlement

The health insurance policy covers hospitalisation, critical illness add-ons, medical costs, ambulance charges, organ donor cover, Aayush treatment and maternity expenses, among other coverage.

When it comes to health plans there is no one size fits all plan. That is why insurance agencies offer tailored plans according to your needs. The best option to buy the best health insurance would be to compare the plans and select the right plan that suits your requirement rather than paying for all facilities. Contact Us for any assistance in comparing and buying health insurance policies at the best price from the top insurance companies in India.

Which Health Insurance is Best in India 2021?

Best health insurance plans should adapt to the changing times and provide the best to their clients. Insurance plans in 2021 have included a comprehensive health care plan that includes coverage for covid home quarantine and other inclusive plans.

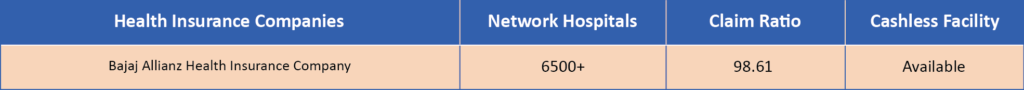

Bajaj Allianz Health Guard is one of them. Let’s see what the insurance provider offers us,

Bajaj Allianz health guard is a comprehensive health plan covering you and your family in a single premium. Availing family floater health insurance plans cover you and your family in a single policy at a single premium. The sum insured ranges between Rs 1.5 lakh for silver plan and three lakhs to Rs 50 lakhs, where one can cover self, spouse, parents, in-laws and up to 4 children aged three months to 30 years. This policy does not include parents/in-laws. The policy is renewable for a lifetime. This plan covers your hospitalisation expenses, maternity-related expenses, Ayurvedic and Homeopathic hospitalisation cover, Bariatric surgery cover, 10% cumulative bonus benefit for every claim-free year up to 100%.

The benefits of the Bajaj Allianz health guard include:

- In-patient Hospitalisation Treatment

- Pre-Hospitalisation

- Road Ambulance

- DayCare facilities

- Organ Donor Expenses

- Convalescence Benefit

- Sum Insured Reinstatement

- Daily Cash Benefit for Accompanying an Insured Child

- Preventive Health Check-Up at the end of every three years and reimbursement of an amount up to Rs 2000

- Daily Cash Benefit for Accompanying an Insured Child

- Ayurvedic / Homeopathic Hospitalisation Expenses

- Maternity Expenses

- Newborn Baby Cover

- Bariatric Surgery Cover

- Cumulative bonus for no claim.

While you decide the best policy for yourself and your family, ensure that the coverage you choose is best for your needs. Remember that being underinsured or picking up the wrong plan could also cause you immense financial difficulties at the time of need. Contact us for any assistance.

Which Insurance Policy Is Best?

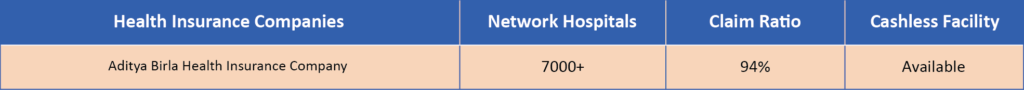

We choose Aditya Birla Activ Assure Diamond Plan for the number of facilities and the claim settlement ratio offered. In addition to this, Aditya Birla Health Insurance offers a wide spectrum of coverage and benefits to its customers. Let’s check the best plan offered by them,

Aditya Birla Activ Assure Diamond Plan

Aditya Birla Activ Assure Diamond Plan from Aditya Birla Health Insurance Co. Ltd offers comprehensive coverage to you and your family with its family floater health insurance plan. The plan is affordable and offers a higher range of sum insured to choose from. The policy gives you a 150% sum insured restoration benefit. Aditya Birla has designed this plan intending to safeguard your family during a medical emergency and assure that you maintain a healthy lifestyle. The insurer offers more than 800 fitness centres, 2300 pharmacies in more than 250 cities, wellness centres and diagnostic centres apart from the hospitals.

Let’s check out the prime benefits offered in this diamond plan,

- 150% reload of the sum insured for subsequent claims up to 50 lakhs.

- Covers 586 daycare procedures for even hospitalisation less than 24 hours

- International/domestic emergency assistance serves, including air ambulance facilities

- Rewards on premium for staying healthy

- 100% unlimited reload of the sum insured in a policy year for unlimited time

- Double the sum insured in two years

- Super NCB and adds on to maximise the accrued NCB for not claiming the insurance.

Apart from these, the key features include Reduced waiting period, Ayush Inpatient treatment, Organ donor expenses, Ambulance cover, Domiciliary hospitalisation (home care),Health checkup program and more. In addition to these features, Aditya Birla health insurance also provides a health coach or wellness coach to provide tips and to coach through an online chat service and a call back service.

Aditya Birla Activ Assure Diamond plan is a wise choice is an intelligent health plan if you are looking for a health insurance plan. It offers many benefits and is budget-friendly too. That being said, all private insurers are competing against each other to give the best plan to their customers. No one health insurance policy can be termed best as insurance cover is best chosen according to individual needs. If you still haven’t made up your mind about choosing a good health cover, contact us.

Which Is Best Cashless Health Insurance in India?

There is not one but many cashless health insurance providers in India who offer the best benefits to their policyholders. Cashless hospitalization is the best option available when in-patient hospitalization is expensive, and you don’t have emergency funds available. With cashless hospitalization, the insurer settles the bill directly with the network hospital instead of reimbursing you. So, opt for a cashless health plan with the most significant number of network hospitals near you. Care health insurance company ranks at the top this year regarding claim settlement ratio and maximum network hospitals across the country.

The Care Health Plan (Formerly Known as Religare Health Plan) offered by Care health insurance offers you annual health check-ups for all members covered under the policy, unique unlimited automatic recharge, about 150% No Claim Bonus with NCB Super, Day-care procedures, Domiciliary Hospitalization, Donor expenses for organ transplantation, coverage for newborn baby, care anywhere–global cover for 12 Critical Illnesses, etc. Other than these, the insurance plan offers

- Comprehensive Coverage

- A broad range of network hospitals of over 6500+ hospitals

- Annual medical check-ups for insured members

- Offers No Claim Bonus

- Waiting period of 24 hours for maternity benefit

- Quick and easy claim settlement

- Not requiring any money at any of the network hospitals

- Hospital daily cash benefit

- Cashless and paperless facilities

- Lifetime policy renewal option

When you want to buy a health insurance policy for yourself with a cashless facility, it is optimum to choose a plan that offers the maximum number of empanelled hospitals. Additionally, you should check if the policy’s coverage is sufficient to absorb the room rent charges and other expenses of hospitalization in the cashless claim.

Contact us for any assistance in comparing and contrasting various cashless health plans and finding you the best one with the highest network hospitals that offer cashless facilities. We will ensure that you pick a plan that ensures the maximum number of treatments.

What Is the Cheapest Health Insurance for a Single Person?

Numerous insurance companies in India offer the best insurance plans at competitive pricing and attractive premium discounts. So, when you choose health insurance, you need to note that the insurance should fit your needs and budget while not compromising on the coverage features.

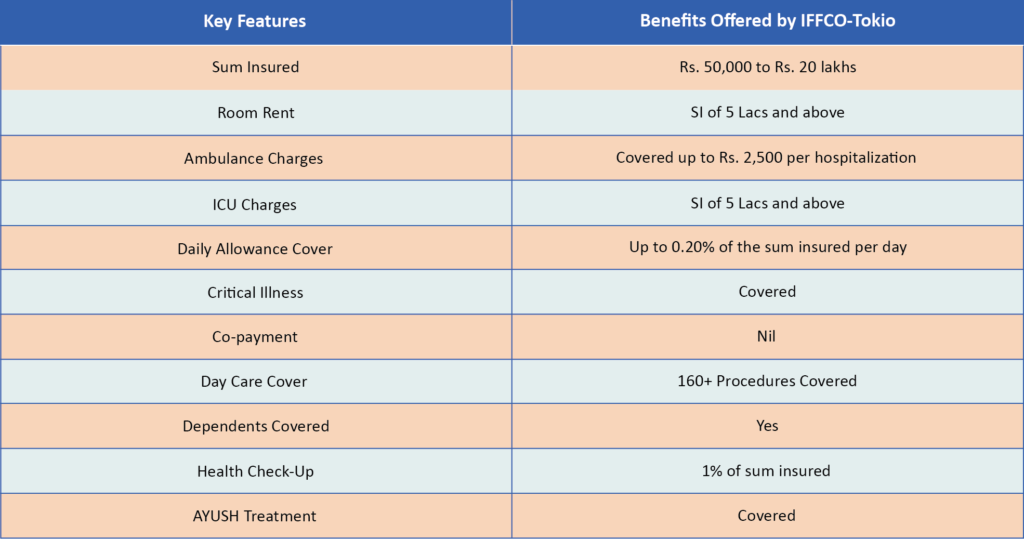

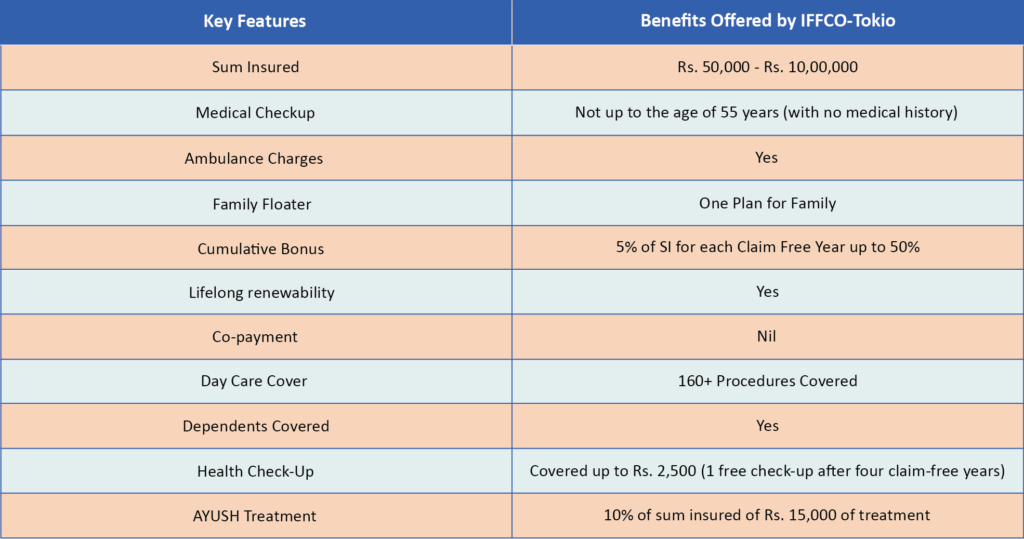

The health insurers offering the cheapest plans available so far are Iffco Tokio General Insurance,SBI General Insurance and New India Assurance, out of which Iffco Tokio Is our pick. Iffco Tokio offers comprehensive health plans at affordable rates. In addition, the insurance company has around 6400+ network hospitals and a claim settlement ratio of 92%.

Finding the perfect health insurance plan for you can be tricky, especially when the plans are difficult to understand and the pricing and coverage are not always comprehendible. To know more about Iffco tokio health plans or any other assistance,click here to talk to us.

How Much Health Insurance Should I Buy?

Buying adequate health insurance with the proper coverage can help you secure your medical and living conditions. There is no particular amount of coverage that can be recommended as it depends on health care costs, individual requirement and budget. Until recently, health insurance up to 3 lakhs was considered sufficient for an individual and five lakhs for family floaters. However, the medical costs in India are rising at double the inflation rate. A recent report states that the medical rate is expected to rise by 10% in India for 5% inflation. The rising health care costs and new illnesses are pushing individuals to opt for higher comprehensive coverage. Cashing in on the trend, the insurance companies offer covers ranging from Rs 50 lakh to 1 crore. These covers envelope higher maternity, baby care, post-treatment, OPD and day-care procedure covers, insure organ donation, air ambulance, fitness consultation and others. They do not apply sub-limits to room rent too.

That being said, there is no standard amount of coverage that you can suggest for an individual. The coverage is suggested based on several factors like the type of hospital, current age, health condition of self and family members, budget etc. The amount of health insurance that you must buy should be linked to your income and lifestyle. Choosing an insufficient cover will prove futile, while choosing a comprehensive cover that doesn’t give you the optimum benefits will burn a hole in your pocket. Hence it is always recommended to go for a customized optimum solution to suit your needs. For any assistance contact us. We know every individual plan on the market to suggest the one most suited to you.

Which Is the Cheapest Health Insurance in India?

There are around 30+ insurers in India currently, and all compete with each other to offer affordable health plans to their customers.

The health insurers offering the cheapest plans available so far are Iffco Tokio General Insurance,SBI General Insurance and New India Assurance, out of which SBI General Insurance is our pick. SBI health insurance offers plans at affordable prices. In addition, it provides comprehensive coverage, including hospitalization, day-care procedures, medical care at home, health risks for an individual and their family.

The secret of obtaining the cheapest health insurance is to customize your health plans to tailor your needs to pay only for what you require instead of paying for all. Another critical factor is that premiums differ from age to age; hence the earlier you take the insurance, you will obtain the lowest possible premium under a plan.Then, contact your insurance aggregator to pick the best plan that suits your requirement at the best price in the market.

How Much Is Health Insurance Per Month for A Single Person?

In 2021, the average cost for health insurance can range between Rs 200 to Rs 1000 for an individual per month. However, costs will vary according to the individual’s selection of health plans. Individual health insurance costs vary according to their personal choices in coverage, age, income, location, number of dependents insured in your coverage, health care use, and more. Comprehending the relationship between health coverage and cost will enable you to choose the right health insurance for you. If you need any assistance in comparing the health care plans, reach out to us at 97167-20000.

Which is the Best Insurance Policy?

Health insurance policy has become a prerogative in the current times. With the need for medical treatment rising at almost double the rate, having the best health insurance policy is the need of the hour. With so many options to choose from, picking the best plan is sure to be confusing. When it comes to the best insurance policy, Reliance Health Infinity is our pick. Reliance Health Infinity is a comprehensive health plan that offers you a wide range of benefits and covers up to eight members of your family. The premium amount to be paid for this plan for the year is Rs 15347. The plan offers an insured sum of up to Rs 30 lakhs and additional cover for enhanced protection. The prime USP of this plan is that it offers benefits without sub-limit like Hospital room rent, Road ambulance charges, Organ Donor expenses and Ayush benefit. The other benefits offered by this plan include,

- Daycare treatment coverage

- 90 days free cancellation

- Robotic surgery for quick recovery

- Restore benefit – Equal to 100% of Sum Insured

- 90 days pre & 180 days

- Post hospitalization expenses

- Wide range of sum insured from Rs. 3 Lacs to Rs. 1 crore

An optimum policy should have the best rate of premium and a wide range of services offered. That being said, every individual has different requirements and preferences. Hence the best insurance policy for one will not be the best for another. Hence it is advisable to consult your insurance aggregator before you buy an insurance policy. Without due research, you might end up settling for a plan with lesser coverage and benefits though you paid a high premium.

How Much Should a Good Health Insurance Plan Cost?

More than the cost, a good health insurance plan should offer comprehensive coverage with easy claim settlement. If you buy adequate health insurance with adequate coverage, it can help you secure your medical and living conditions. There is no specific amount of coverage that can be recommended as it depends on an individual/family’s health care costs, individual requirement and budget. Health insurance up to 3 lakhs is sufficient for an individual and five lakhs for family floaters until now.

For an idea of approximation, a basic family floater plan covering yourself, your spouse and a child would cost around Rs 10,000 to Rs 17,000 annually. A Rs 5 lakh individual health plan will cost a 35-year-old Rs 4,000-7,000 a year.

To buy a good health insurance plan,call an insurance aggregator to compare and give you a customized solution that will suit your needs at the right premium amount.

How Much Should Good Health Insurance Cost?

In the current times, good health insurance costs an individual around five lakhs, which amounts to 4000-7000 per year. A family floater plan for a family of three will cost approximately Rs10,000 to 17,000 annually.

That being said, with medical costs in India rising steeply every year. Hence, it is imperative to buy an insurance plan that offers you the solutions you need so that you don’t pay for all the services offered. Another critical factor that affects the insurance cost is your age and lifestyle diseases. Hence there is no one size fits all when it comes to good insurance. Choose your budget and requirements and contact your insurance aggregator to pick the best plan that suits your requirement at the best price in the market.

How Much Do You Spend on Insurance Per Month?

The average annual premium for individual coverage in 2019 was Rs 10,000 to 17,000 annually for a minimum health cover of Rs 5 lakh. So, a 5 lakh insurance costs you around 200-250 per month. You can have a similar sum assured as a family floater to include your family members. That being said, The costs of medicines and healthcare are shooting up steeply every year.Stats say that the medical rate is expected to rise by 10% in India for 5% inflation. This Rise in costs may render your individual Health Insurance cover inadequate to cover all expenses. The rising health care costs and new illnesses are pushing individuals to opt for higher comprehensive coverage. The monthly costs depend on the type of services you like to avail of and your age budget and lifestyle habits. Hence there is no standard amount of coverage that you can suggest for an individual. Choose a sufficient cover based on your requirements. Take care that you don’t end up paying more than you require for lesser coverage. For any assistance contact us. We know every individual plan on the market to suggest the one most suited to you.

Is It Worth to Have Health Insurance?

If you are young and healthy with no illness or living more paycheck to paycheck, you may wonder if it is worth having health insurance. But in today’s situation, it is always better to stay prepared for any emergency. Let’s face it. Healthcare costs are on a steep rise, and it will drain a person in lakhs which takes a toll on their plans. Health plans in today’s times cover a lot of benefits to make your investments worth it. Here are a few,

Pre and Post Hospitalization Expenses

All health insurance plans cover the cost of hospitalization in case of an accident or illness. By hospitalization, the plans also cover the cost of OPD (out-patient department) expenses, diagnostic rest taken and more. Few insurance plans even cover post-hospitalization charges and daily allowance cover.

Income Tax Benefits

Payments made towards health insurance premiums qualify for tax deductions under section 80D of the Indian Income Tax Act. Additionally, Individuals up to 60 years of age can claim a tax deduction of up to Rs 25,000 for the health insurance premium paid for themselves or their dependents.

Shifting Lifestyle

In current times, we are prone to more health disorders than in the past. The commute, irregular eating habits, stress, lack of sleep, rising pollution, and the quality of food affect our health. If there is a policy in place, one doesn’t have to primarily depend on the savings to tackle health emergencies at the time of need.

Additional Benefits

Health insurance covers additional benefits like domiciliary expenses for unique treatments like Unani, Ayurveda, Acupuncture and Acupressure are covered in your health insurance. Moreover, many insurers have tie-ups with fitness consultants and centres for you to stay fit and healthy. Additionally, one also gets benefits like ambulance coverage, free health checkups, vaccination expenses, etc.

Better Treatment

Many health insurers have tie-ups with the best hospitals to provide you with the best treatment without waiting time. Plus, they offer cashless treatment where the insurer directly takes care of your bills with the hospital without involving you.

If you already have health insurance from your employer, check for the coverage offered in your plan. Having a higher sum assured will take care of your finances. Go for a top-up plan above the existing cover to secure your future. Insure early to stay secured. If you need any help choosing the optimum plan for you, contact yourinsurance aggregator for assistance.

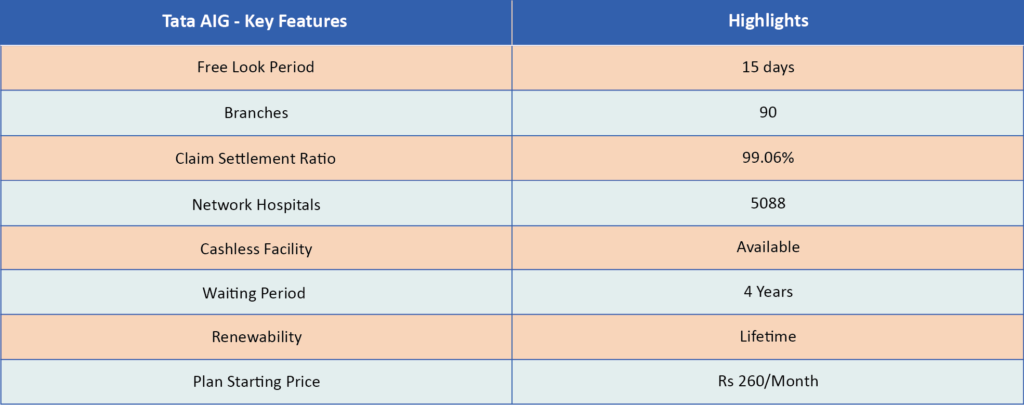

Is Tata AIG Good Insurance?

Yes.Tata AIG is good insurance. Established in 2001, this insurance company is one of the top providers in the market for almost two decades. This joint venture between the TATA Group and the American International Group (AIG) has four health care plans to offer. The premium starts at Rs 313 to 470 for both individual and family floater health plans. The best part is that the insurer provides coverage for covid treatment. The insurer offers cashless treatment in its tie-up hospitals, and reimbursement is done in the case of a non-tie-up hospital. The insurer has a 94.21% Claim Settlement Ratio 2021 per the annual report for 2019-2020 stated by IRDAI.

The Tata AIG offers perks that include:

- Coverage for covid treatment

- Cashless hospitalization at 7200+ hospitals

- No room rent restrictions on Medicare Premier/MediCare

- Restore Benefits

- In-patient Treatment

- Consumable Benefits

- Cumulative Bonus

- Tax Benefits under section 80D

- Daycare procedures

- Domiciliary treatment

- Organ donor coverage

- Tax benefit under the second 80D of Income Tax Act,1961

To choose the right plan for you that offers the right coverage, consult with us before taking a call.

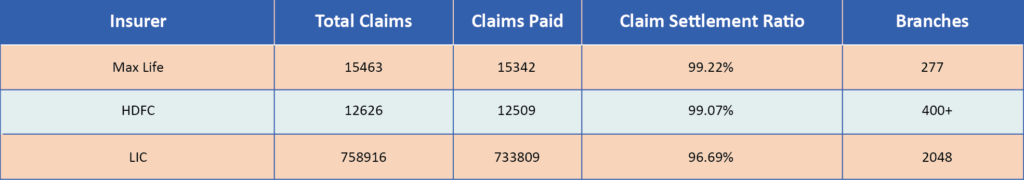

Who are The Top 3 Insurance Companies?

Currently,57 health insurance companies in India compete with each other to give the best coverage at the best prices to their customers. To find the top plan for you, it is always recommended to talk to an insurance aggregator or fill a form including your requirements. They will suggest the optimum insurance policy according to your requirements.

Let us see each company in detail,

Max Life Company

Max Life Insurance Company, which was established in 2000, is the largest non-bank private sector life insurance company in India. The company has its headquarters in the national capital New Delhi. The insurer offers a lot of comprehensive plans, including long term protection, saving and retirement plans. The insurer has around 269+ branches in India, as mentioned in the IRDAI report FY 2019-2020. They also stand in the first place according to claim settlement ratio.

HDFC

The HDFC Life Insurance Company was established in 2000 and stood second in India based on the claim settlement ratio FY 2019-2020. The HDFC Life Insurance Company was established in 2000. The company spans across the country through 412 branches and also has a robust digital platform. It was the first life insurance company to offer pension plans to new customers under the new IRDAI launch. HDFC insurance plans offer comprehensive protection along with additional add on options. The company offers one day claim settlement and fast response to its customers.

Life Insurance Corporation of India

This insurance player has been dominant in India and has become more like a family insurer of the country. Established in 1956, it is the largest life insurance company in India. Owned by the government of India, the insurance company has 2048 branch offices across the country. The company has many policies under its hood that choosing one within the company can be quite a dilemma. To make things easier for you, we can schedule a call and discuss the optimum plan to suit you best.

What Kind of Insurance is AIG?

Tata AIG General Insurance Company has been in the market for the past 20+ years. Established in 2001, the insurer offers all kinds of insurance ranging from automobile, property, travel, agriculture and more. It has around 90 offices across the country and a solid digital presence. Additionally, it has tie-ups with 5088 cashless hospitals across the country. Tata AIA stands third in the country with a 99.06% claim settlement ratio this year as per the report started by IRDAI. The insurer also offers covid cover, international medical treatments etc., to its customers. In a nutshell,

Which Car Insurance Company has the best Settlement Ratio?

Motor insurance is compulsory for vehicle owners in India under the Motor Vehicle Act,1988. While choosing a car insurance policy, the Claim settlement ratio is one of the critical factors to look for in your insurance company. This reliable metric helps you determine if the insurer is good at settling your expenses when the need arises. Claims for car insurance are sought when there is damage by a third party, accident, theft, etc. the claim amount is obtained by calculating the insured’s insured value and the type of insurance policy purchased. As of 2021, IFFCO Tokio General Insurance has the best claim settlement ratio for car insurance in India. The company offers a claim settlement ratio of 95.30%. The next in line comes Royal Sundaram General Insurance with a claim settlement ratio of 92.66%, followed by The Oriental Insurance Company at 91.76%. The IFFCO Tokio General Insurance leads its competitors by a prominent difference undoubtedly.

Contact us to know more about any insurance company or choose the best car insurance company at the lowest rates in the market. We are happy to assist you.

Is Tata AIG Cashless?

Yes, The insurer has tie-ups with 5088+ network hospitals across the country concerning health insurance and cashless garages to customers who sign up for motor insurance. The insurer has more than 5000+ network garages in the country. The insurer offers easy and hassle-free cashless services to its customers. To buy plans offering cashless services,contact your insurance aggregator to check if the plan offers maximum networks at your location and suits you the best.

What is the Best Medical Insurance for Seniors?

Health care costs are on the rise, and it is imperative to buy the best medical insurance that offers comprehensive medical support for your elderly parents. Senior Citizens require frequent health check-ups to keep track of their healthy being. Hence choosing a preliminary plan that would not cover their health risks would prove futile. Therefore, it is practical to choose the right insurance policy for them carefully.

Currently, Senior citizen plans often come with many limitations like higher premium, stringent medical check-ups, co-payments, waiting periods; hence it is essential to check the terms and conditions before buying insurance for them.

Many insurance players in the market offer unique and comprehensive plans to sustain competition in the market. Choosing one among them would be a difficult task indeed.

Currently, Activ Care – Senior Citizen – Aditya Birla Capital is our pick for a plan that offers comprehensive cover, senior citizen. The policy offers coverage on an indemnity basis where the medical expenses incurred are paid to the customer as a claim. The plan covers basic hospitalisation expenses while also providing coverage for home treatments, air ambulance in domestic and international emergencies, health assessments, etc. It offers no limit on room rent and ICU. It also offers attractive discounts and attractive premiums with a wide range of facilities offered. The benefits of the plan include,

- Sum insured is reloaded in case of exhausting the claim

- Organ donor expenses covered under Classic and Premier coverage

- Home treatment cover for up to a specific specified limit

- Value-added benefits like health assessment, health coach, health returns and more

- Second medical opinion in case of a critical illness

- The plan also offers add ons like Nursing at home cover, Lifestyle support equipment, Advanced health check-up cover, Portable medical equipment cover, room upgrade and more.

Contact us to discuss the optimum plan that will suit your requirement to arrive at the best plan at the right price together.

What is the Highest Rated Medicare Supplement plan?

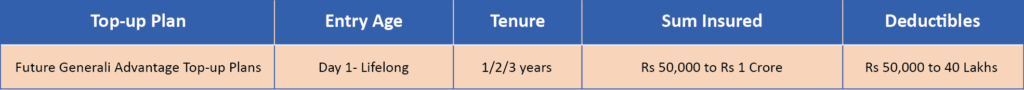

Medicare supplement plans are the add ons that cover the gaps of the existing policy to supplement your basic health cover. It is also known as Top-up Plans in India. These plans are helpful when your coverage amount gets exhausted due to insufficient coverage. The best part is that a top-up plan can be purchased even when one onset has a primary medical policy. When it comes to the highest-rated medicare supplement plans, we choose Future Generali Advantage Top Up plans.

Do Seniors Get Free HealthCare?

There are more than133 million senior citizens (aged 60 years or above) in India. Most senior citizens rely on investments and savings to stay financially independent. With age, medical issues increase owing to age-related ailments. Presently, the elderly are provided health care by the general healthcare delivery system in the country. The National Programme for the Health Care for the Elderly (NPHCE) by the Ministry of Health and Family Welfare offers easily accessible, preventive, promotional, curative and rehabilitative health services for the elderly. The ministry of Ayush also offers medical facilities for the elderly. But when it comes to free health care options for seniors to be treated in private hospitals, there are none. Private hospitals have the edge over government hospitals for the advanced care and medical facilities provided. Hence the need for a senior citizen health care plan is imperative. When it comes to health cover, there are a lot of government schemes with senior citizen benefits like Varishta Mediclaim Policy, Pradhan Mantri Jan Arogya Yojna(PM-JAY), Senior Citizen Savings Scheme (SCSS), Pension Schemes etc. Private Insurers compete with each other too to provide the best health insurance policy for senior citizens. The benefits provided by private health insurance companies include benefits like inpatient hospitalization cover, alternate treatment cover, annual health checkups on a cashless basis, cashless treatment at any network hospital, ambulance costs, domiciliary hospitalization, pre and post hospitalization and more.

If you opt for senior citizen health insurance, it is always good to go for a plan with a reasonable sum insured.Contact us to help you choose the right plan for you. We are happy to customize the best plan for you. Call us at 97167-20000.

How Much is Health Insurance for Seniors?

Health insurance for seniors offers coverage to the elderly between ages 60 to 80 years. It secures their health and provides a cashless facility that saves a lot of hassle of arranging cash in lump sum during emergencies. Many health insurances offer

- Comprehensive Coverage

- Cashless Treatments

- Day Care Treatments

- Pre-Existing Diseases Cover

- Lifelong Renewability

- Pre-medical Tests

- Tax Benefits

On average, a premium health insurance plan for seniors costs starts from Rs. 27,689/year. A basic Rs 5 lakh health cover for senior citizens starts at approximately Rs 300 per month. Premium plans with a varied range of benefits are offered at a starting price of Rs 1770/month.

To get the plans with ideal coverage without burning a hole in your pocket, call us at 97167-20000. We know all insurance providers in the market. So let’s compare all to make an informed choice.

What are the 10 Best Insurance Companies?

Health insurance has become an absolute need in the current times. With the inflation in the health care costs every year, backing yourself with a health cover will help you not use up your savings for medical treatments. There are around57 health insurance providers in India. Out of which, we have picked up the top 10 based on their network hospitals, plan benefits, annual premium, solvency ratio and claim settlement ratio.

| S.No | Insurer | Annual Premium FY 2019-2020 (in Crores) | Network Hospitals | Claim Ratio % FY 2019-2020 | Solvency Ratio % FY 2019-20 | Cashless Facility |

| 1 | Star Health and Allied Insurance Company | 6,719 | 10,200+ | 99.9 | 1.69 | Available |

| 2 | HDFC ERGO | 3624 | 10,000+ | 99.8 | 1.77 | Available |

| 3 | ICICI Prudential | 2695 | 6500+ | 97.84 | 2.2 | Available |

| 4 | Care Health Insurance | 2151 | 15500+ | 100 | 1.53 | Available |

| 5 | Bajaj Allianz Health Insurance Company | 2139 | 6500+ | 98.61 | 2.45 | Available |

| 6 | Reliance General Insurance Company | 1365 | 7300+ | 98.16 | 1.53 | Available |

| 7 | Max Life | 1178 | 5000+ | 99.22 | 1.5 | Available |

| 8 | Tata AIG | 835 | 6200+ | 92.82 | 1.84 | Available |

| 9 | Aditya Birla Health Insurance Company | 756 | 7000+ | 94% | 1.64 | Available |

| 10 | SBI General Insurance | 742 | 6000+ | 97.84 | 2.21 | Available |

| 11 | Cholamandalam MS General Insurance Company | 316 | 7240+ | 91.47 | 1.56 | Available |