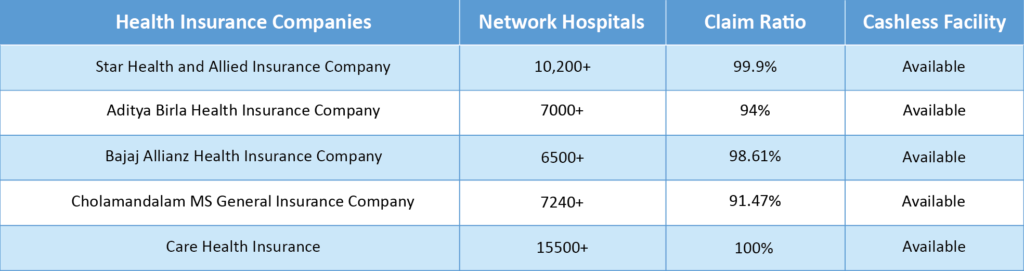

There are about 57 health insurance companies in India, out of which 24 are life insurers, and 33 are non-life insurers. All these 57 companies offer the best plans available in the market. As a customer, it would be daunting to choose one among the many options available to you with respect to health insurance. Hence, we have curated the best insurance companies for you to make an informed choice. Here are the top 5 health insurance companies for you,

Let us see each company in detail,

Star Health and Allied Insurance Company

Star Health and Allied Insurance Co. Ltd. is India’s first Standalone Health Insurance provider established in 2006. It is famous for its disease-specific health insurance products that cater to the needs of every customer. The company has a widespread network of hospitals with more than 640 branch offices across India. The insurer provides top-up insurance plans that you can customise as per the insured’s requirement. The star health plans also come with a lifetime renewability option.

Aditya Birla Health Insurance Company

Aditya Birla Health Insurance Co. Ltd (ABHICL), a subsidiary of Aditya Birla Capital Ltd, has a nationwide distribution presence in over 650 cities. They received the “Insurance Asia Awards” for Domestic Life Insurer of the Year 2019. The insurer offers more than 800 fitness centres, 2300 pharmacies in more than 250 cities, wellness centres and diagnostic centres apart from the hospitals.

Bajaj Allianz Health Insurance Company

Bajaj Allianz, founded in 2001 by Star Health and Allied Insurance Co. Ltd., is India’s first Standalone Health Insurance provider. The company has offices that span over 1100 towns and has bagged the award for the ‘Best Insurer in India 2020’ by the IDC Financial Insights Innovation Awards. The company is famous for its customised plans like Hospital Cash and coverage against critical illness.

Cholamandalam MS General Insurance Company

Cholamandalam Insurance collaborates between the Murugappa Group and Mitsui Sumitomo Insurance Company Limited, a leading Japanese agency. It was honoured with the Golden Peacock Award for Risk Management for the year 2017. The insurance company spans over 136 branches across India. The insurer provides health plans, top-up plans and critical illness insurance plans.

Care Health Insurance

Care Health Insurance, formerly known as Religare Health Insurance, is regularly appreciated and promoted by the famous Fortis Hospitals. The insurer has a plan for everyone’s requirements. It also offers a “health care heart plan” for annual cardiac check-ups.

Once you choose a health insurance company, you can select a health care plan from the wide range of products they offer. Compare their different insurance plans and find the best insurance policy that suits you. Call us for any assistance.

H2: What is the Best Health Insurance for 2021?

Since the previous year, the world has been living in anxiety and uncertainty due to the pandemic. With the need for medical treatment rising, having the best health insurance plan is the need of the hour. But with so many options to choose from, finding out the best plan for you will make a tough choice. An optimum policy should have the best rate of premium and a wide range of services offered. Without due research, you might end up settling for a lesser one. We at cover 360 have curated the Best Health Insurance available for 2021, offering a wide range of services and suits your budget. Let’s check it out,

Aditya Birla Activ Health Platinum-Enhanced

The Aditya Birla Activ Health Platinum-Enhanced is a comprehensive health coverage made to support the policyholder and their family during a medical emergency. The sum insured ranges between Rs 2 Lakh to Rs 2 Crore. Chronic illnesses such as diabetes, cholesterol and asthma are covered in the plan. Additionally, the policyholder can avail for a refund of consultation charges, medical test charges and day-care procedure. They also provide a cumulative bonus of 20% for each claim-free year.

Bajaj Allianz Health Guard

Availing family floater health insurance plans cover you and your family in a single policy at a single premium. The sum insured ranges between Rs 2 lakh to Rs 1 crore, where one can cover self, spouse and up to 4 children. This policy does not include parents/in-laws. This plan covers your hospitalisation expenses, maternity-related expenses, Ayurvedic and Homeopathic hospitalisation cover, Bariatric surgery cover, 10% cumulative bonus benefit for every claim-free year up to 100%

Care Health Insurance Plan

This comprehensive health plan provides hospitalisation and various medical charges that include in-patient care, day-care treatment, pre-hospitalisation, and organ donor with a hefty sum assured of INR 6 Crores. It offers an optional cover of unique Unlimited Automatic Recharge under which the sum assured amount is automatically recharged if the health cover is exhausted. Apart from the primary cover, Care Plan gives the policyholders annual health check-ups for all members covered under the policy, up to 150% No Claim Bonus with NCB Super and care anywhere with global cover for 12 significant illnesses. It is an affordable lifetime plan for individuals above the age of 5 years.

Bajaj Allianz Extra Care Plus Policy

Bajaj Allianz Extra Care Plus Policy acts as a super top-up policy by adding more comprehensive health protection to your family. It takes care of the additional medical expenses after your existing health insurance plan is exhausted. The Extra Care Plus Policy comes with coverage options that range from Rs 3 lakh to Rs 50 lakh for premiums as low as Rs 2500 per annum. The benefits it offers include in-patient hospitalisation costs, pre-hospitalisation and post-hospitalisation costs, road ambulance cover, air ambulance cover, free medical check-ups, and more.

Star Health Family Optima Plan

Star Health Family Optima Plan is an affordable super saver plan available under a single sum insured amount of INR 25 Lakh. It provides a coverage plan for the entire family members right from 16-day old new-born baby and other family members. The coverage includes neonatal coverage, neonatal coverage, in-patient coverage, air ambulance, organ donor expenses and a free health check-up for every claim-free year. It also comes with a lifetime renewal for neonatal coverage.

Look out for various factors, including health insurance riders, benefits, coverage, network hospitals, claim ratio etc., to make an informed choice. Take special care not to be underinsured as it causes incredible financial difficulties. Click here for any assistance in comparing and buying health insurance policies from the top insurance companies in India.

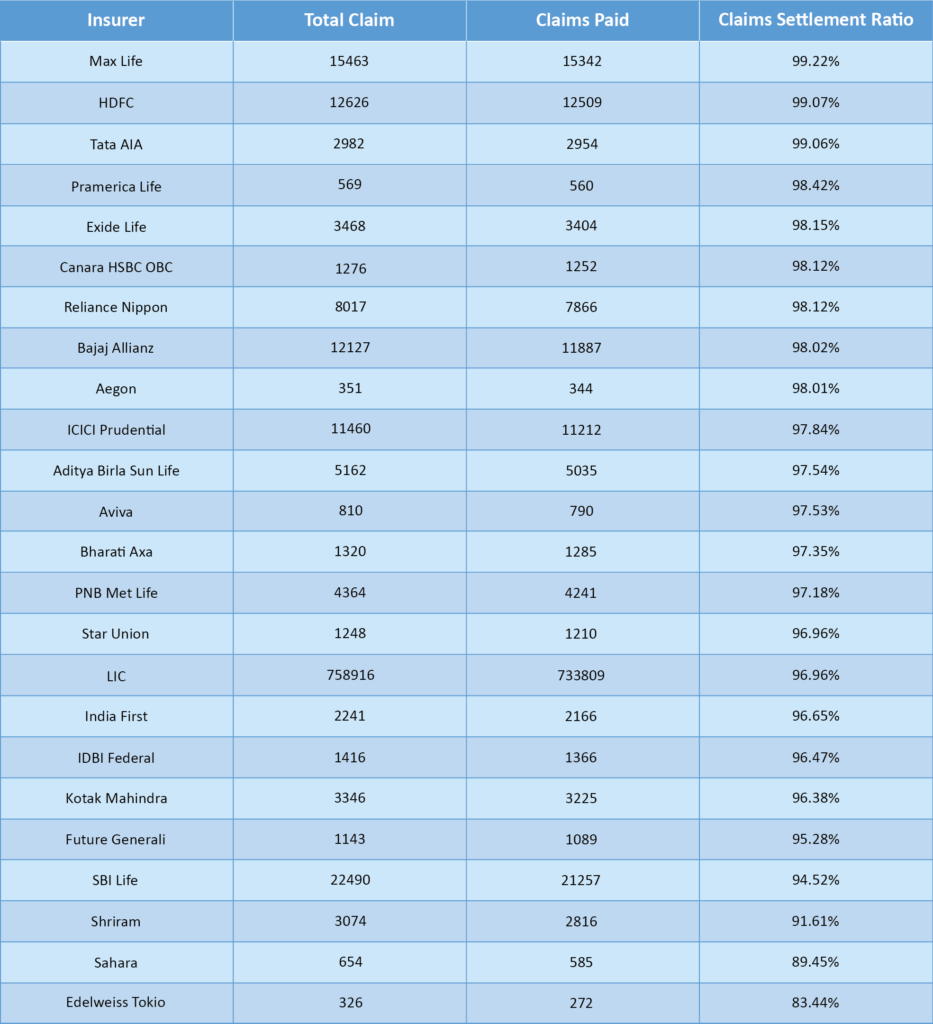

Which Insurance Company Has The Highest Customer Satisfaction?

Claim Settlement Ratio (CSR) is the measurement to quantify the claims settled by the insurance companies every financial year. The CSR is calculated based on the total number of claims against the number of claims settled. The increased Claim Settlement Ratio indicates that a company is customer-friendly and quick at settling claims.

The 2021 annual report for 2019-2020 stated by IRDAI states max life insurance to have the highest claim settlement ratio with 99.22%. Trailing the max life insurance comes HDFC with 99.07% and TATA AIA life insurance with 99.06 percentage. The report is as follows,

Life Insurance Claim Settlement Ratio Data for 2021 (FY 2019-20)

It is to be noted that the most significant life insurance company, LIC of India, has a claim settlement of 96.69%, which is a colossal feat owing to the number of claims it receives each year.

The Annual report makes one thing evident: many insurers have claim per cent more than 98%. Hence it is required to consider the benefit amount that the life insurer has settled to make a more informed choice. In case of any assistance required,click here to talk to us.

Is It Worth Buying Private Health Insurance?

Medical emergencies can be unpredictable. Insurance is indeed an additional expense, and it might seem tempting to overlook it. But the fact Is that health insurance is necessary for every individual, young or old, owing to the fact that medical costs and lifestyle diseases are on the rise. +to take health insurance, public or private sector are the same. While government health insurance is undoubtedly more affordable, private health insurances offer an array of extra benefits like,

Better Control Over Your Health Care

The primary health insurance plans in private insurance have changed with time to more customised and increased benefits. Private insurance lets you choose from a vast array of hospitals. It also lets you choose your doctor. Nowadays, there are private health insurances that offer coverage for fitness centres, pharmacies, wellness centres, and diagnostic centres apart from the hospital bills incurred. So, taking health insurance gets you covered in all aspects.

No Waiting in Queues for Treatment

Patients have no option but to wait in queue if they can’t afford the private hospital bill. With private health insurance, the queries are gone, and you do not have to think twice before paying extra for an express consultation if required.

Cashless treatment

Many insurers have tie-ups with hospitals so that you can avail yourself of cashless treatment and not worry about arranging the cash during an emergency.

More Choices

Private health insurance providers have tie-ups of 5000+ hospitals all over the country, giving you the leverage of choosing the hospital.

More Money Back on Other Health Services

Private insurance provides more sum insured and covers a wide range of facilities. That way, you get more money back while availing of the services.

Improved Facilities

You get to choose the Private health care facilities well maintained,with private wards, private bathrooms, phones, TVs, and better-tasting food.

Accommodative Plans

Private health insurance offers a lot of customised, flexible plans according to your needs. The recent addition of few private insurances considering home quarantine for the medical claim is an example of this. The new-age insurers cover medication, consultation, diagnostic charges for those who have opted for home treatment.

Be it public or private insurance; it is always best to compare and choose the right plan according to our needs and budget. If you need any assistance,we are happy to help you.

How much should I be paying for health insurance?

Health insurance premiums are an individual decision and cant be constant for all. Your health insurance payment depends on factors like your age, prevailing health condition, family medical history, lifestyle, etc. health insurance premiums are calculated depending on all the above factors. So, there isn’t any right amount that can be specified while considering health insurance. To get a customised plan tailored for your individual needs, please contact us. We are happy to help you with the right plan.

Is ICICI Lombard good insurance?

Yes. ICICI Lombard General Insurance Ltd. is one of India’s largest private sector general insurance companies, offering insurance coverage for motor, health, and travel. This year, it is an established insurance agency with several hospital tie-ups and a claim ratio of 97.84%. They also offer basic plans like OPD solutions, maternity cover and Ayush cover.

The ICICI Lombard offers benefits that include,

- Cashless treatment

- It covers the cost of hospitalisation, daycare procedures, medical care at home (domiciliary hospitalisation), ambulance charges, etc.

- Tax benefit claim under section 80D of the Income Tax Act, 1961.

- No limit on room rent

- It covers pre and post hospitalisation

- Covers pre-existing diseases

- Covers ambulance expenses

- Provides additional sum insured

- It covers Wellness programs like joining a gym or a yoga centre, going for a medical checkup, participating in a health or fitness event organised.

- Free health checkups every year.

- To choose the right ICICI Lombard insurance plan for you, click here to zero down the plan.

To choose the right ICICI Lombard insurance plan for you, click here to zero down the plan.

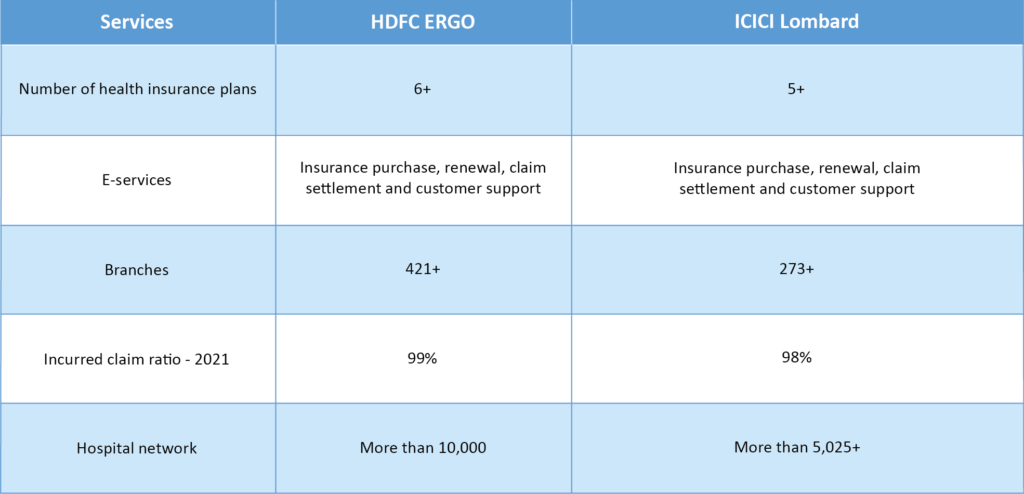

Which is better, HDFC or ICICI Lombard?

HDFC ERGO has been in the insurance market serving customers since 2002. The company offers several insurance plans such as individual, family, senior citizens, critical illness, COVID-19, etc.

ICICI Lombard on the other hand was established in 2001. It offers several types of insurance policies. Its health covers include a complete health plan like personal protection policy, health booster, Aarogya Sanjeevani Policy, COVID-19 cover etc.

Comparing HDFC or ICICI, The ICICI Lombard offers more or less the same benefits as COVID-19 Insurance Plans, critical illness covers, etc.

To compare in detail and choose between any two insurers, feel free to consult with us before taking a call.

How much is ICICI Lombard a month?

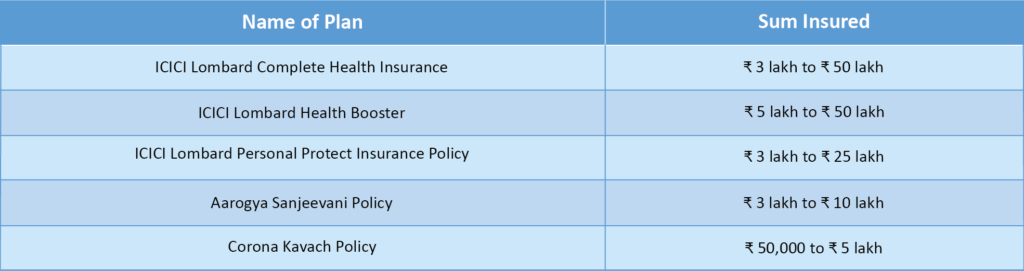

The monthly charges for ICICI Lombard depend on the plan that you choose. The coverage offered starts from ₹5 lakh for a monthly premium as low as ₹542. There are five health insurance plans offered by ICICI Lombard which are,

For more assistance to choose the plan that is suitable for you or to know more about the ICICI Lombard plans in detail, Call or WhatsApp @ 97167-20000

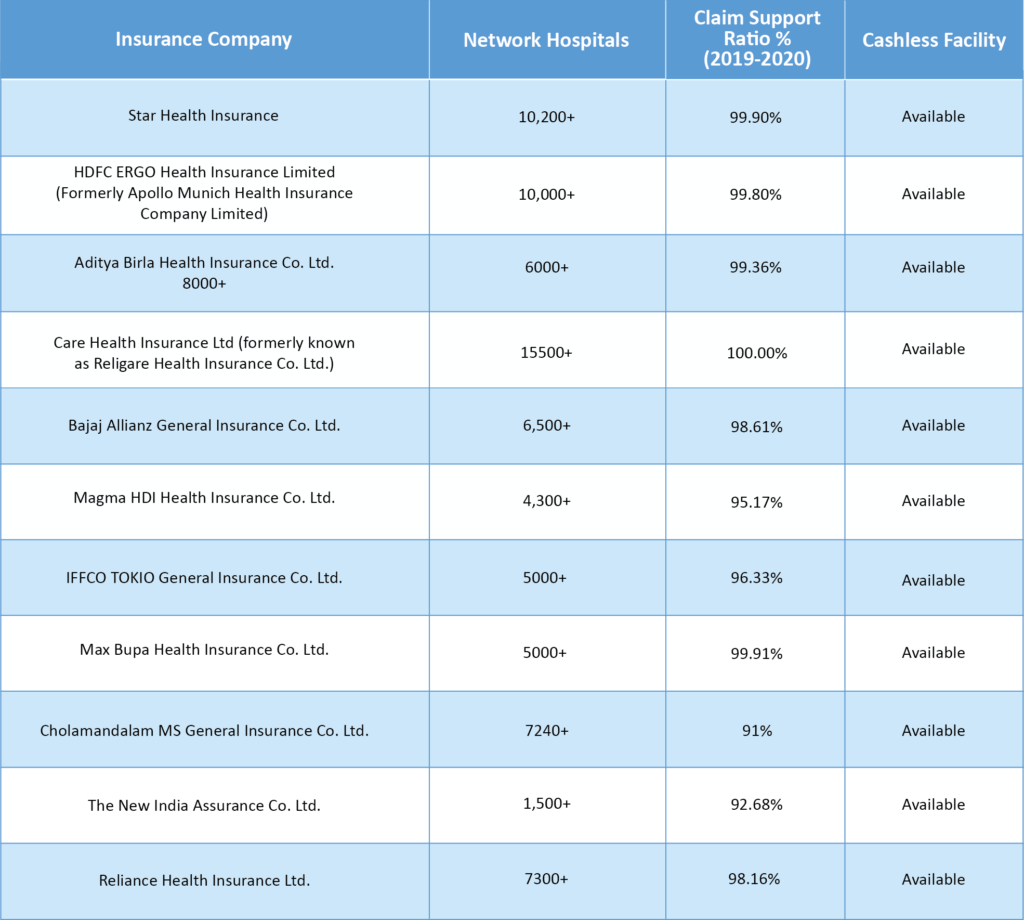

What are the Top 10 Health Insurance Companies?

There are 30 health insurance providers in India, and choosing one from the plethora of options is daunting. The insurance providers compete to provide you with the best deal of health insurance to its customers.

Here we have listed the top 10 health insurance providers in India to check various criteria while selecting the best health insurance plan suitable to your requirement.

When choosing the right plan for you, you could compare the top providers on criteria like coverage benefits, claim ratio, network hospitals and other features based on your requirement to make an informed choice. Call us if you need any assistance.

Who owns health insurance companies?

The insurance sector, in general, has been growing tremendously in the past decade. Earlier, the customers had only Life Insurance Corporation of India (LIC) and General Insurance Companies (GIC) to choose from. But currently, 30 companies in India offer customers health insurance policies. Out of the 30, 26 are private insurance companies, and 4 are public insurance companies. Most of these companies have tie-ups within international firms and have brought up innovative plans and varied coverage according to modern needs. These modern plans offer coverage for fitness, homoeopathy, free health checks, home quarantine and more. Check out the health insurance companies operating in the market as of 2021,

| Insurer | Location | CEO/CMD |

| Acko General Insurance Ltd. | Mumbai | Mr Varun Dua |

| Aditya Birla Health Insurance Co. Ltd. | Mumbai | Mr Mayank Bathwal |

| HDFC ERGO Health Insurance Limited (Formerly Apollo Munich Health Insurance Company Limited) | Haryana | Mr Anuj Tyagi |

| Bajaj Allianz General Insurance Co. Ltd | Pune | Mr Tapan Singhel |

| Bharti AXA General Insurance Co. Ltd. | Mumbai | Mr. Sanjeev Srinivasan |

| Cholamandalam MS General Insurance Co. Ltd. | Chennai | Mr. Venkateswaran Suryanarayanan |

| Manipal Cigna Health Insurance Company Limited | Mumbai | Mr. Prasun Kumar Sikdar |

| Max Bupa Health Insurance Co. Ltd | NEW DELHI | Mr. Krishnan Ramachandran |

| Navi General Insurance Ltd. | Mumbai | Mr Ramchandra Pandit |

| Edelweiss General Insurance Co. Ltd. | Mumbai | Ms Shubhdarshini Ghosh |

| ECGC Ltd. | Mumbai | Mr M. Senthilnathan |

| Future Generali India Insurance Co. Ltd. | Mumbai | Mr Anup Rau |

| Go Digit General Insurance Ltd | PUNE | Mr Ritesh Kumar |

| ICICI LOMBARD General Insurance Co. Ltd. | Mumbai | Mr Bhargav Dasgupta |

| IFFCO TOKIO General Insurance Co. Ltd. | Gurugram | Ms Anamika Roy Rashtrawar |

| Kotak Mahindra General Insurance Co. Ltd. | Mumbai | Mr Mahesh Balasubramanian |

| Liberty General Insurance Ltd. | Mumbai | Mr Roopam Asthana |

| Magma HDI General Insurance Co. Ltd. | Mumbai | Mr Rajive Kumaraswami |

| National Insurance Co. Ltd. | West Bengal | Mrs. Tajinder Mukherjee |

| Raheja QBE General Insurance Co. Ltd. | Mumbai | Mr Pankaj Arora |

| Reliance Health Insurance Ltd. | Mumbai | Mr Gajendra P. Singh |

| Care Health Insurance Ltd (formerly known as Religare Health Insurance Co. Ltd.) | Gurugram | Mr Anuj Gulati |

| Royal Sundaram General Insurance Co. Ltd. | Chennai | Mr M S Sreedhar |

| SBI General Insurance Co. Ltd. | Mumbai | Mr. Prakash Chandra Kandpal |

| Shriram General Insurance Co. Ltd. | Jaipur | Mr Anil Kumar Aggarwal |

| Star Health & Allied Insurance Co.Ltd. | Chennai | Mr V. Jagannathan |

| Tata AIG General Insurance Co. Ltd. | Mumbai | Mr Neelesh Garg |

| The New India Assurance Co. Ltd | Mumbai | Mr Atul Sahai |

| The Oriental Insurance Co. Ltd. | NEW DELHI | Mr Anjan Dey |

| United India Insurance Co. Ltd. | Chennai | Mr Girish Radhakrishnan |

| Universal Sompo General Insurance Co. Ltd. | Mumbai | Mr Sharad Mathur |