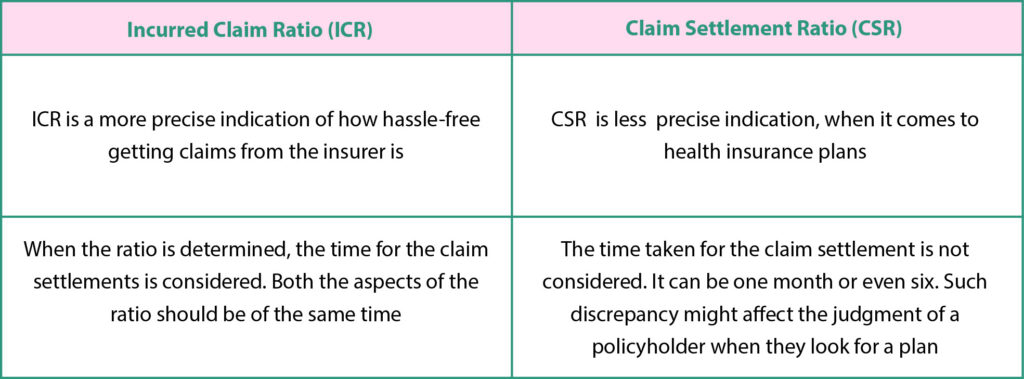

Incurred Claim Ratio (ICR) and Claim Settlement Ratio (CSR) are two among the most important terms when it comes to a health insurance policy. You may have come across these terms while searching for a health insurance plan. As a layman, you might be unable to find differences between them. But ICR and CSR are different.

Comparing different mediclaim policies offered by different insurance companies can actually be a daunting task. There are multiple subjective matters that can be considered to narrow down the search for the best health insurance policy. However, we usually skip to take into account the numbers as well as figures.

Incurred claim ratio and Claim settlement ratio are two such objective factors. You cannot afford to skip them when it comes to purchasing a health insurance plan. Let’s elaborate, in detail, the differences between these two ratios that may help you select the best insurance plan without any one’s help during the coronavirus pandemic in India.

What is a claim?

Before we dig out these ratios, understanding a health insurance claim is important. A claim is a formal communication raised by the insured person to his/her insurance company to get the sum insured as per the policy agreement.

What is the Incurred Claim Ratio in Health Insurance?

- The ICR for a specific health insurance policy is the ratio of the total claims that have been approved or settled by the insurance company and the total value of premiums that have been paid to the same insurance company.

- Both of these must be calculated over the same time period.

- The more the ICR of an insurer, the more the claims that have been accepted by the company.

- Although a high ICR may indicate an easier time getting your claims, if it is more than 100%, it means that the company might be at a loss.

- In that case, it might not be safe to buy the policy in the long run.

Say, for example, if a particular health insurance provider had approved a total claim of Rs.80 crores in the year 2020 against the premiums received amounting to Rs.100 crores, it would specify that the ICR is 70% in 2020. In case the ICR is very low for a general or health insurance company, it means that the company’s claim settlement process is not good enough to purchase a policy..

What is the Claim Settlement Ratio in Health Insurance?

- CSR is the proportion of the claims that is approved or settled against the total number of claims that the insurance provider has received.

- However, most health insurance plans do not state their particular claim settlement ratios but the overall claim settlement ratios of the insurance provider.

Say, for example, if an insurance company approves the claims amounting to Rs.80 crores against a total of Rs.100 crores, then the claim settlement ratio of the health insurer is 80%. A higher CSR reflects that the claim settlement process is better than the insurers with a low claim settlement ratio.

Please note that higher the claim settlement ratios, better are the chances of your claims getting approved by the insurance provider. Because the claim settlement ratio of an insurer reflects its reputation and prestige, it is good to first compare this parameter with different health insurance companies before choosing one for your health plan.

Conclusion

In India, many health insurance plans from a number of health insurance companies are available. Top health insurance companies are IFFCO Tokio General Insurance, Care Health Insurance, Magma HDI Health Insurance, The Oriental Insurance Company, Bajaj Allianz General Insurance, Max Bupa Health Insurance, HDFC ERGO General Insurance, Manipal Cigna Health Insurance, Future Generali General Insurance and more.

It is crucial to narrow down your search and get the most suitable one based on their ICR and CSR report. Remember that the incurred claim ratio for a specific health insurance plan is a more accurate and precise indicator of how easy it is to get claims from the policy, looking at that factor is better.