More than 30+ insurance companies in India compete to deliver the right policy to their customers. The insurance companies are neck to neck in the competition, right from offering the best plans to settling the claim within 2 hours. Hence choosing the best insurance company to buy a health care plan is a little tricky. So, what does a good medical insurance company entail? Let’s take a look!

Checklist to Choose the Best Health Insurance Company

Check Company’s Credentials

Checking the reputation of the insurance company is the first and foremost thing to be done. A company’s reputation is essential as it indirectly signifies the support they offer their customers and the quick claim settlement ratio. It is also essential to find out the insurers claim solvency ratio to get a velar idea about the claim settlement probability.

Check All Options

Choose the insurer that offers more options for you to choose from. Health insurance companies offer a varied range of plans to suit their customer’s needs. Health plans are not one size fits all package. So, it is imperative to check and carefully choose your health plan according to tour budget and requirement criteria.

Cashless Hospital Network

Though most insurers provide the facility of cashless hospitalization, look for the ones who have tie-ups with most hospitals in your location. That way, your claim will be settled directly by the insurance provider without any hassle. The cashless policy is a boon to customers as it saves the hassle and waiting time of collecting the bills and receipts and submitting the same to wait for the claim to be settled.

Sub-Limits on Treatments

Most health insurance providers put sub-limits on consultation fee, daycare, home treatment, etc. Insurance providers have a sub-limit that you can’t avail a daily room rent over 1-1.5 times of the sum assured, making you bear the remaining cost. So check your insurance company terms and conditions and get to know the sub-limits, if any.

Waiting Period on Coverage

Almost all insurance companies have this. The waiting period is the span between the start of the policy and when it starts to provide the coverage for the plan insured. The duration of the waiting period and its terms and conditions vary from Company to Company. Hence it is required to check it to understand if the plan they offer will be of use.

No Claim Bonus

As the name signifies, the no claim bonus is the reward provided by the insurer for not raising any claim during a policy year. The no-claim bonus varies based on the insurer. A discount will also be offered to the insured while renewing the claim. Therefore, go for an insurer who offers you a No Claim Bonus on your plan.

Streamlined Processes

Look for an insurer with good customer care and a friendly, streamlined process. The last thing a person needs at the time of crisis is to be stuck figuring out how to process and file the claim. Choose an insurer who has a well-defined process when it comes to policy-related actions such as raising a claim, applying for a policy, tracking your application, etc.

Lastly, go for an insurer who has an established online presence as it makes your life easier right from paying premiums, viewing NAV funds online, calculating policy premiums, processing claims, contacting customer care and more.

If you have any doubts about choosing the right insurer for you, contact us to get comprehensive details about any insurer ranging from their claim settlement ratio, solvency ratio and other details.

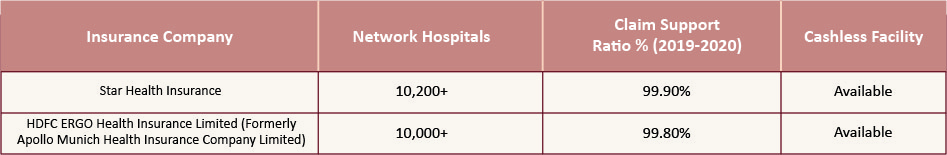

Which is Better? Star Health or HDFC Ergo?

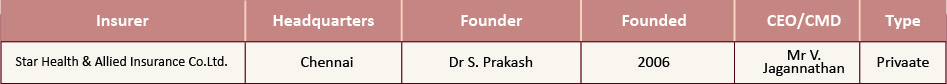

Star Health and Allied Insurance Ltd is India’s first Standalone Health Insurance provider established in 2006. It is well known for its disease-specific health insurance plans that cater to the needs of every customer. The company has a vast network of 10,200+ hospitals. The insurance provider spreads its branches with more than 640 branch offices across India. The insurer provides top-up insurance plans that you can tailor as per the insured’s requirement. The star health plans also come with a lifetime renewability option.

The Star Health and Allied Insurance offers benefits that include,

- No co-payment

- The insurance doesn’t require a co-payment. However, it has an exception for customers between the age of 61 to 65 years, where 20% of the claim has to be settled by them.

- Life–long renewability

- Pre-existing diseases

- Pre-existing ailments are covered after a waiting time of 4 years.

- Room rent:

- The star insurance plans come with room rent expense at 2 percent of the sum assured subject to a maximum of 4000 per day.

- Faster claim settlement

The health insurance policy covers hospitalisation, critical illness add-ons, medical costs, ambulance charges, organ donor cover, Aayush treatment and maternity expenses, among other coverage.

HDFC ERGO has been in the insurance market, serving customers since 2002. The company offers several insurance plans such as individual, family, senior citizens, critical illness, COVID-19, etc.

The HDFC ERGO Insurance offers benefits that include,

- Tax benefits under section 80d of the income tax act.

- Free health check-up once every four years

- No-claims bonus

- Top-ups and super top-ups for more extensive coverage at a lower premium

- Restore or regain benefit on exhausting the sum insured

For more assistance to choose the suitable plan for you or to know more about the Star Health Insurance and HDFC ERGO plans in detail, Call or WhatsApp on 97167-20000.

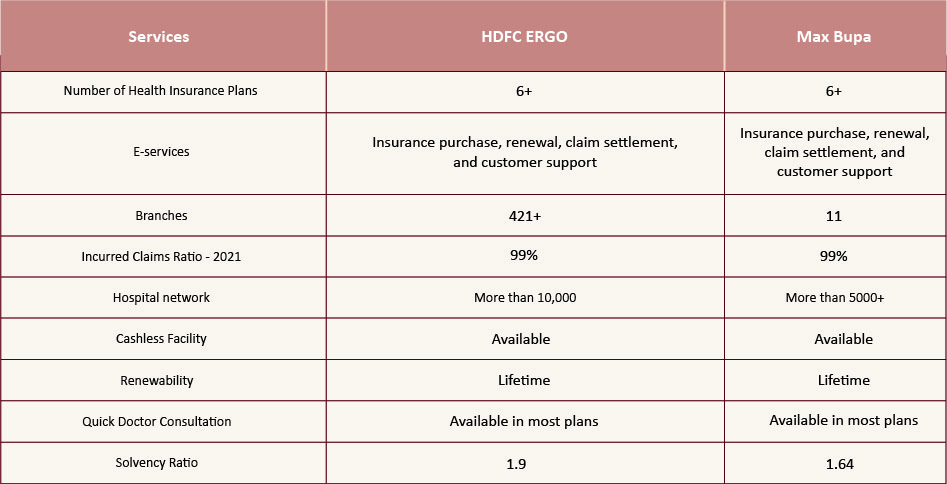

Which is Better, Max Bupa or HDFC Ergo?

HDFC ERGO has been in the insurance market, serving customers since 2002. The insurer offers several insurance plans such as individual, family, senior citizens, critical illness, COVID-19, etc.

Max Bupa, on the other hand, was established in 2008. It offers several types of insurance policies. Its health covers include a complete health plan like personal protection policy, health booster, Aarogya Sanjeevani Policy, COVID-19 cover, etc.

To see more health insurance plans, click here.

Comparison of Individual and Family Health Insurance Plans Offered – Max Bupa Vs HDFC Ergo

Max Bupa offers health insurance plans like HEALTH COMPANION, GOACTIVE, HEALTH PREMIA, MONEY SAVER, HEALTH PULSE, SUPERSAVER, etc. The benefits offered by these plans include,

- Pre-and post-hospitalisation, annual check-up, alternate treatment, daycare treatment, in-patient care, organ donor transplant, enhanced NCB, Enhanced refill benefits, emergency ambulance, health check-ups, maternity and newborn care, Annual health check-up etc.

- Covers enhanced benefits like a health coach, second opinion costs, OPD consultation, home healthcare services, etc. in the advanced family plans

- Few policies have a co-payment feature available

- Provides extended plans for larger families

- Covers psychological healthcare expenses

- Offers add-on features like critical illness cover, e-consultation (unlimited), enhanced no claim bonus etc.

HDFC ERGO provides a comprehensive and budget-friendly health insurance policy for you and your family. The key features of the health plan include:

- No Entry Age Restriction

- Covers expenses like pre-and post-hospitalisation, in-hospital, daycare procedures, AYUSH treatment, cashless home healthcare, health check-ups, etc.

- Covers psychological healthcare expenses

- No Medical Test Up to 45 Years

- Offers lifetime renewability

- Free Renewal Health Check-up

- Health insurance plans from HDFC Ergo come with lifelong renewal, thus saving you from the stress of uncalled medical emergencies.

- Some plans offer no sub-limit on room rents.

- 5% bonus on the sum insured for every claim-free year.

Please consult with us before taking a call to compare in detail and choose between any two insurers. We are happy to help you pick the perfect plan.

Who is the Owner of Star Health Insurance?

Star Health Insurance is provided by Star Health and Allied Insurance Co. Ltd., India’s first Standalone Health Insurance provider established in 2006. The company is owned by Dr S. Prakash. The insurer offers a variety of disease-specific health insurance products that cater to the needs of every customer. The company has a vast network of hospitals with more than 640 branch offices across India.

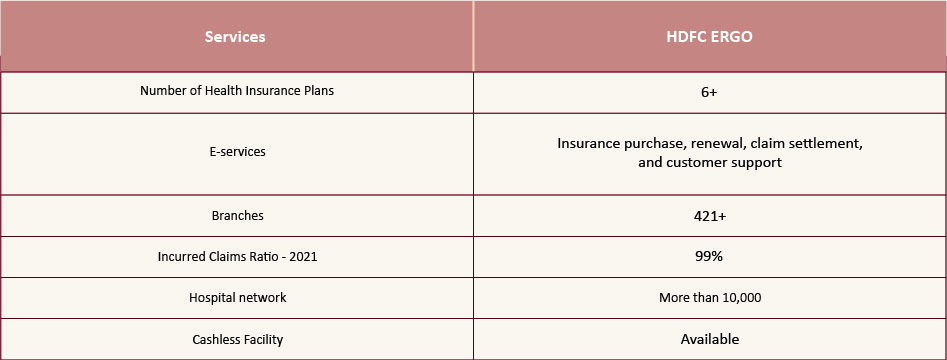

Is HDFC ERGO Health Insurance Good?

HDFC ERGO Health Insurance Plans provide you with various comprehensive indemnity plans, medical plans, fixed benefit plans, Top-up plans and critical illness plans. It offers a range of health-related services like cashless treatment and hospitalisation at 10,000+hospitals, daycare treatments, no room rent restriction, AYUSH cover, In-patient hospitalisation, pre and post hospitalisation, and more.

The services offered by HDFC ERGO have been listed below.

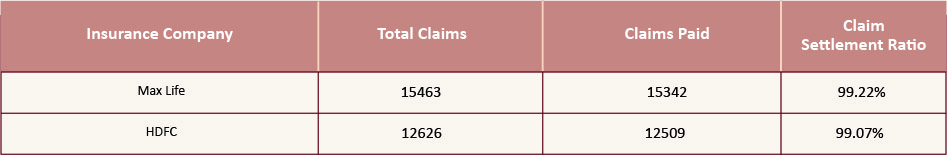

The insurer also ranks second among the insurers with the highest claim settlement ratio according to the 2021 annual report for 2019-2020 stated by IRDAI.

The benefits offered by HDFC ERGO Health Insurance plans offer its customers are,

- Cashless Home Health care**

- Covers pre-and post-hospitalisation, in-hospital, daycare procedures, AYUSH treatment, cashless home healthcare, health check-ups, etc.

- Covers psychological healthcare expenses

- No Entry Age Restriction

- Sum Insured rebound

- Cumulative Bonus

- No Medical Test Up to 45 Years

- Reimbursement for financial losses at home on hospitalisation above ten days.

- Lifelong renewability

- Free Renewal Health Check-up

- Health insurance plans from HDFC Ergo come with lifelong renewal, thus saving you from the stress of uncalled medical emergencies.

- Some plans offer no sub-limit on room rents.

- 5% bonus on the sum insured for every claim-free year.

The HDFC ERGO also offers affordable top-up plans that offer higher coverage at a lower premium.